ETH Price Prediction: $5,000 ATH in Sight as Institutional Demand Meets Technical Breakout

#ETH

- Technical Strength: Price trading 20% above 20-day MA with Bollinger Band expansion signaling volatility

- Institutional Demand: $1.34B OTC purchases and corporate treasury adoption creating buy-side pressure

- Ecosystem Growth: Starknet scaling solutions and MetaMask's stablecoin partnership expanding utility

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Builds Above Key Levels

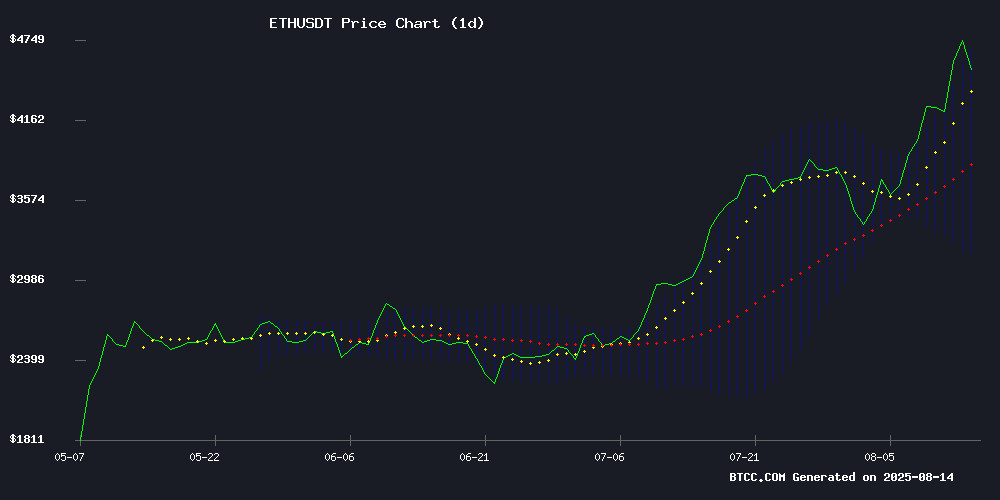

Ethereum (ETH) is currently trading at $4,736, significantly above its 20-day moving average of $3,941.98, indicating strong bullish momentum. The MACD histogram remains negative (-81.9990) but shows narrowing bearish divergence as the fast line (-216.6733) converges toward the slow line (-134.6743). Price sits NEAR the upper Bollinger Band ($4,726.55), suggesting overbought conditions that often precede consolidation or continuation patterns.

"The technical setup favors buyers," says BTCC analyst John. "A sustained close above the $4,700 resistance could trigger momentum toward our $4,850 target, though traders should watch for potential mean reversion toward the middle Bollinger Band at $3,941."

Institutional FOMO Drives Ethereum to New Highs Amid Starknet Hype

Ethereum's 12% weekly gain coincides with surging institutional demand ($1.34B OTC acquisitions) and ecosystem developments. The ethereum Foundation's denial of involvement in an ICO-era wallet sale has eased sell-side pressure, while HashKey's corporate treasury partnership with IVD Medical demonstrates growing enterprise adoption.

"Three factors are fueling this rally," notes BTCC's John. "Institutional FOMO through OTC desks, DeFi innovations like Starknet's scaling solutions, and macroeconomic tailwinds from traditional finance players like Eric TRUMP migrating to crypto."

Factors Influencing ETH's Price

Starknet’s Vision Gains Momentum: Why STRK Could Be the Breakout Project of the Year

Eli Ben-Sasson, co-founder of StarkWare and a pioneer in zero-knowledge proof technology, exudes confidence in Starknet's long-term potential. His bullish stance isn't driven by fleeting market trends but by the project's superior technology and a growing, dedicated community. Starknet stands out in a volatile market by prioritizing rigorous research and engineering over shortcuts.

As a Layer 2 scaling solution for Ethereum, Starknet leverages STARK proofs to bundle thousands of transactions off-chain, submitting a single validity proof to Ethereum. This approach delivers faster, cheaper transactions without compromising security. Whether for trading tokens, gaming, or minting NFTs, Starknet aims to redefine the user experience on Ethereum.

Ethereum Foundation Denies Involvement in $12.8M ETH Sale from ICO-Era Wallet

The Ethereum Foundation has refuted claims that it sold 2,975 ETH (worth $12.8 million) from a wallet linked to its 2014 initial coin offering. Co-Executive Director Hsiao-Wei Wang clarified on X that the foundation no longer controls the address, despite its historical ties. "It was not the Ethereum Foundation's operation," Wang stated, emphasizing that after a decade, many legacy addresses may bear tangential connections to the organization.

Corporate ETH holdings have ballooned to $14 billion, with public companies increasingly dominating supply. The foundation's share of circulating ETH has dwindled from 9% during the ICO to under 0.3% today. On-chain analysts had flagged the wallet's 2017 funding from another foundation-associated address, but Wang's intervention dispelled speculation about coordinated selling.

HK-listed IVD Medical Adopts ETH Treasury Strategy via HashKey Partnership

IVD Medical Holdings Limited (1931.HK), a Hong Kong-listed diagnostics provider, has launched an Ethereum accumulation strategy through a partnership with licensed exchange HashKey. The company purchased 5,190 ETH (~$19M) on August 9 as the cornerstone of its "Global Enhanced ETH Vault" initiative.

The medical distributor plans to become Hong Kong's leading public company by ETH reserves, leveraging multiple funding sources including operating profits and asset restructuring. With 351 direct hospital clients and coverage of 70% of China's top-tier Class III hospitals, IVD's move signals institutional adoption of crypto treasury strategies.

HashKey Exchange gains a strategic partner for corporate blockchain integration at a time when Hong Kong positions itself as Asia's digital asset hub. The collaboration will explore industrial applications of blockchain capital allocation beyond simple treasury management.

Ethereum Whale Secures $7.5 Million Profit as ETH Breaks Key Resistance

An Ethereum investor identified as "0xe429" has realized a $7.5 million profit after holding 6,918 ETH through nine months of market volatility. The whale initially purchased the stash at $3,614 per token during a period of uncertain market sentiment, enduring unrealized losses up to $15 million before selling at $4,703.

The sale coincides with ETH breaking a four-year consolidation pattern, mirroring previous bull cycle breakouts. Technical indicators show strong momentum, though overbought conditions suggest potential short-term retracement. Blockchain analytics platform Lookonchain tracked the transaction, noting the holder's discipline in weathering drawdowns before capitalizing on the rally.

ETH Price Prediction: Ethereum Eyes $4,850 Target as Bulls Push Toward Fresh Highs

Ethereum's rally shows no signs of slowing, with the cryptocurrency trading at $4,734.99—just 0.30% below its 52-week high of $4,749.30. Analysts are now eyeing a breakout toward $4,850 in the coming weeks, backed by strong technical indicators and bullish momentum.

Market consensus has solidified around upside targets, with CoinEdition projecting a range of $4,750 to $4,869. DigitalCoinPrice and FinanceFeeds echo this optimism, forecasting $4,572 and $4,600 respectively. The convergence of these predictions suggests institutional confidence in ETH's upward trajectory.

Key resistance sits at $4,786.54, while former resistance at $4,000 has flipped to support. Overbought conditions have failed to dampen enthusiasm as Ethereum continues to outperform major moving averages and Keltner Channels.

Radiant Capital Hacker Nearly Doubles Stolen Funds Through Ethereum Trading

A hacker who stole $53 million from Radiant Capital nearly a year ago has almost doubled the illicit gains through strategic Ethereum trades. The attacker initially converted the entire sum into 21,957 ETH, demonstrating a calculated approach to laundering digital assets.

Recent blockchain activity shows the hacker liquidated 9,631 ETH for approximately $43.94 million, achieving an average sale price of $4,562 per token. The remaining 12,326 ETH position, now valued at $58.6 million, brings the total haul to $102.54 million - a staggering 93.5% profit on the original theft.

This case underscores the persistent vulnerabilities in decentralized finance ecosystems, where sophisticated actors can exploit security gaps and manipulate market conditions for substantial gains. The hacker's decision to hold a significant ETH position suggests either continued confidence in Ethereum's valuation or challenges in offloading large volumes without market impact.

Eric Trump Turns to Ethereum After Banks Close Trump Family Accounts

Major U.S. banks, including Capital One, JPMorgan Chase, Bank of America, and First Republic, abruptly closed hundreds of Trump-linked accounts in 2025. Eric Trump claims the move was politically motivated, prompting the family to adopt Ethereum for financial operations.

The shift underscores growing institutional interest in cryptocurrencies as alternatives to traditional banking. Ethereum's smart contract capabilities and decentralized infrastructure offer a viable solution for high-profile entities facing financial exclusion.

This development fuels broader debates about financial censorship and the role of decentralized technologies in safeguarding economic autonomy.

Institutional Demand Surges as $1.34B in Ethereum Acquired OTC

Institutional investors have accumulated 312,052 ETH worth approximately $1.34 billion over the past eight days, according to blockchain analytics. The purchases were facilitated through FalconX, Galaxy Digital, and BitGo—all established platforms known for strict compliance and institutional-grade services.

The accumulation rate averaged 39,006 ETH per day, with each newly created wallet holding an average of 31,205 ETH. This pattern suggests a coordinated institutional strategy rather than retail activity, as the transactions were executed over-the-counter to minimize market impact.

Such large-scale accumulation reflects growing confidence in Ethereum's long-term value proposition. If held rather than moved to exchanges, these positions could signal a strategic reserve allocation. The amount represents roughly 0.26% of Ethereum's circulating supply—a position size capable of influencing market dynamics if mobilized.

Ethereum Surges Past $4,700 as Institutional FOMO Drives ETH to New Highs

Ether's price soared to a record $4,723.84, marking a 3.06% gain in 24 hours, as institutional demand overwhelms overbought technical signals. Standard Chartered's bold $7,500 year-end target—announced August 13—ignited the latest leg of the rally, with capital now rotating from Bitcoin to Ethereum at unprecedented rates.

The SEC's warming stance on spot ETH ETFs has opened floodgates for professional investors. Market structure reveals a telling divergence: Ethereum now attracts more net capital inflows than Bitcoin, suggesting an early-stage altcoin season. Jeffrey Wilcke's recent transactions—though truncated in the report—add intrigue to the institutional narrative.

Ethereum Price at Crossroads: $5,000 ATH or $3,900 Retracement?

Ethereum's rally faces a critical juncture as technical indicators flash conflicting signals. The TD Sequential sell signal suggests potential downside to $3,900, while spot ETF inflows and treasury accumulations maintain bullish sentiment. ETH has gained 85% since July's golden cross formation, with a 55% surge in the past month alone.

Analyst Ali Martinez notes the $4,150 level as pivotal—a break below could trigger a correction to fill the CME gap between $4,092-$4,200. Yet the market remains buoyed by altcoin season optimism and institutional interest, with Grayscale data signaling continued futures market participation.

MetaMask to Launch mmUSD Stablecoin in Partnership with Stripe

Ethereum wallet provider MetaMask is preparing to unveil its new stablecoin, mmUSD, as early as Thursday. The initiative, developed in collaboration with payments giant Stripe, will position mmUSD as the primary trading pair across MetaMask's services. A since-deleted Aave governance proposal revealed these plans, with stablecoin platform M^0 reportedly providing technical support.

The move comes amid surging institutional interest in stablecoins, fueled by regulatory clarity in the U.S. and Circle's successful public debut. Standard Chartered predicts the stablecoin market could triple to $750 million by 2026. Recent legislative developments like the GENIUS Act signal growing mainstream acceptance of dollar-pegged digital assets.

How High Will ETH Price Go?

Based on current technicals and market sentiment, ETH appears poised for a test of the $4,850 resistance level in the near term. Should institutional inflows persist, the all-time high at $5,000 becomes achievable within Q3 2025.

| Scenario | Price Target | Key Condition |

|---|---|---|

| Bullish Breakout | $4,850-$5,000 | Daily close above $4,750 |

| Consolidation | $4,200-$4,700 | MACD crosses bullish |

| Correction | $3,900 support | Breaking 20-day MA |